HEALTH AND FORESIGHT

Living in Germany means navigating and understanding the health and social security systems to ensure you have the right coverage. FinQuest helps you find the solution that perfectly matches your profile and your needs, so you can move forward with confidence and peace of mind.

Foresight

Occupational Disability Insurance

Why it matters?

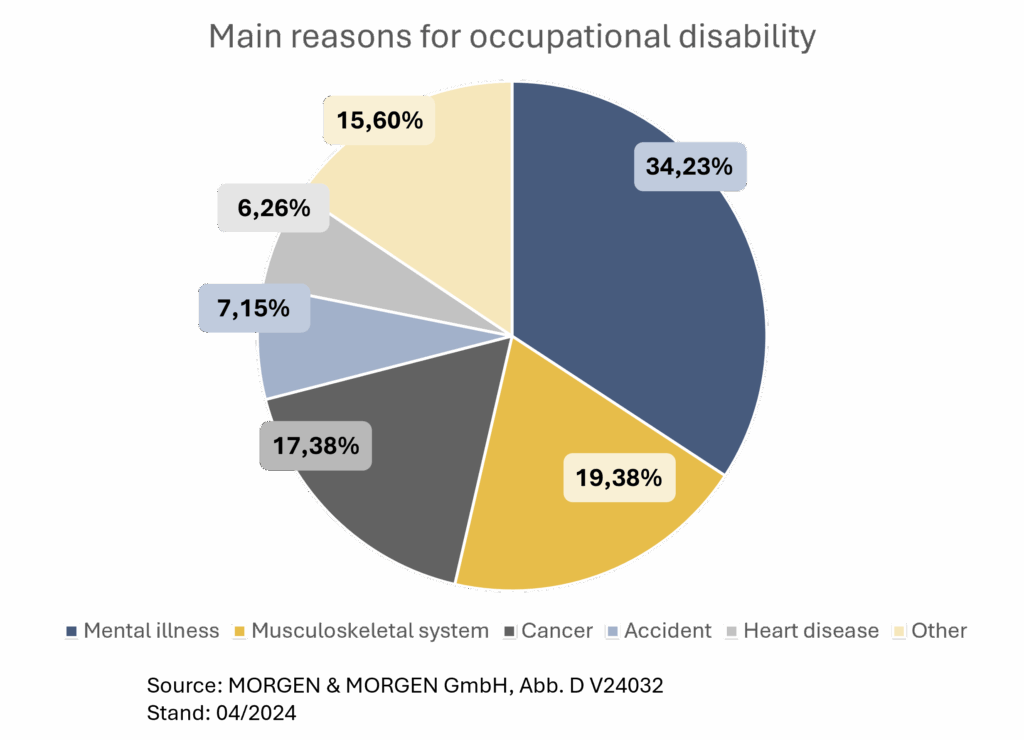

What would happen if an illness or accident kept you from working for several months or even longer? Without an income, everyday essentials like rent, food, and bills quickly become a challenge.

That is where disability insurance (income protection) comes in. It provides financial security when your employer or health insurance does not step in anymore, giving you peace of mind when you need it most.

Public coverage does exist, but qualifying is difficult, and even if you are eligible, the benefits are often too low to cover your basic expenses. With private protection, you take control and secure your revenues.

Who needs it?

Short answer: everyone

Foresight

Death and Long-Term Care Insurance

Death Insurance

This insurance provides financial security for your family in the event of your death. It can help maintain their standard of living and ensure the repayment of a mortgage or other loans.

Long-Term Care Insurance

The benefits provided by public insurance often fall short of covering the actual costs of care. With life expectancy steadily increasing, planning for the possibility of long-term care is a crucial part of sound financial strategy.

A long-term care pension insurance policy can help protect you and your family from the significant financial burden that may arise, such as the expenses of a retirement home or in-home care.

Health Insurance

In Germany, health insurance is mandatory. The system is split into two options: public health insurance (gesetzliche Krankenversicherung, GKV) and private health insurance (private Krankenversicherung).

- Public Health Insurance

- Private Health Insurance

Germany’s public health insurance system is based on solidarity: contributions depend on income, not on individual health risks.

Who is covered?

Employees, students, retirees, job seekers, and other eligible groups. Family members (spouses without income and children) are usually co-insured at no extra cost.

How is it funded?

Contributions are split 50/50 between employers and employees (about 14.6% of gross salary plus a small extra fee depending on your Health Insurance). If you are self-employed, you pay the full amount yourself.

What is included?

Access to a legally defined package of basic healthcare services. Some Health Insurance also add extra benefits to stand out

Complementary health insurance

Want more coverage while staying in the public system? With complementary health insurance, you can enhance your benefits for dental care, alternative medicine, hospital stays, and preventive treatments.

Unlike public insurance, private health insurance is based on age, health, and the coverage you choose, not your income.

Who can get it?

Self-employed individuals, civil servants, and employees earning above €73,800/year (2025). Each family member usually needs their own policy.

How it works

Premiums are individually calculated. Employers may cover up to 50%, but only up to what they would pay in the public system.

What is included

Coverage often goes beyond public benefits: enhanced dental care, preventive treatments, alternative medicine, and faster access to appointments.